DUBAI: Most Gulf Arab oil exporters will enjoy larger budget surpluses this year than previously thought because crude oil prices have rebounded, though a weak global economic outlook will limit GDP growth rates, a Reuters poll showed yesterday.

Since the previous poll was conducted in July, the price of Brent crude climbed to nearly $118 per barrel in mid-September from $98. It has since retreated to $110 per barrel, partly because of signs that the global economy is weakening.

“We do not see upside to the oil price in the forecast horizon, provided the cold war between Iran and the West does not turn into an actual war,” said Giyas Gokkent, chief economist at National Bank of Abu Dhabi.

But analysts believe current levels will allow Gulf Arab countries to strengthen their fiscal positions further, despite their heavy government spending programs.

The latest Reuters poll of 18 analysts, conducted this month, found them raising their 2012 budget surplus forecasts for five of the six members of the Gulf Cooperation Council (GCC).

“The rebound in oil prices over the past few months has helped the fiscal outlook. At current oil prices, almost all GCC countries will run large budget surpluses this year,” said Daniel Kaye, senior economist at National Bank of Kuwait.

Oil and gas revenue provides most of the budget income of Gulf states, which have boosted spending on pensions, wages and other social measures since last year to ease social tensions.

Saudi Arabia, the world’s top crude exporter, is now expected to book a 2012 budget surplus of 15 percent of gross domestic product, above the 13.2 percent predicted in July’s poll. The United Arab Emirates’ surplus is projected at 6.4 percent, up from a previously forecast 5.9 percent.

Kuwait is projected to post the largest surplus, of 23.8 percent of GDP for its fiscal year, which started in April – partly because a political crisis is delaying approval of expenditure on big infrastructure projects.

Bahrain is forecast to be the only GCC country in the red in 2012, with a budget deficit of 1.9 percent of GDP. However, that would be a slightly smaller shortfall than the 2.0 percent gap forecast by the last poll in July.

Bahrain needs an average oil price of nearly $113 to balance its budget, analysts estimate – by far the highest level in the Gulf.

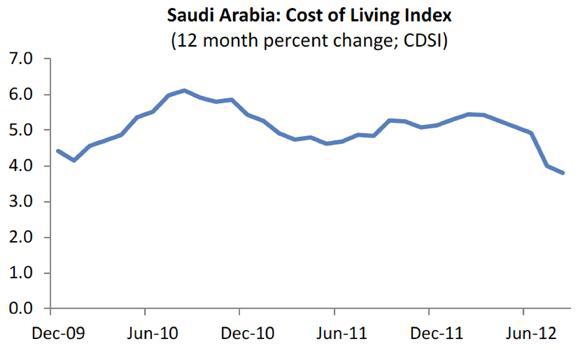

Inflation in the Gulf will be slightly more moderate in 2012 than analysts previously expected, the poll also showed.

In the UAE, which like other Gulf states is heavily reliant on food imports, inflation is now forecast to average a mere 1.3 percent this year, down from 1.5 percent forecast in the previous poll. However, food prices pose a risk since they rose sharply in August because of global trends.

“Inflation declined quite a bit in 2012 as a result of a slower rise in food prices. (But) in the third quarter, commodity prices rose again with easy money policy announcements by central banks,” Gokkent said.

“Our own projections for year-on-year inflation show a rise in coming months compared to current levels for a number of reasons: Domestic stimulus in the case of the GCC; austerity measures in the case of Egypt, Jordan; some pick-up in global food prices is expected as the US drought filters through.”

Analysts believe Qatar, Kuwait and Oman will also see slightly slower inflation than previously projected this year, while living costs in Saudi Arabia will rise 5.0 percent instead of the 4.9 percent expected in July.

ref: www.arabnews.com

Tags: budget surpluses, Gulf states, heading, larger

Leave a Reply

You must be logged in to post a comment.